Okay, okay, I get it— seeing the word “BUDGET” in a blog title doesn’t make most people excited to read the content. I used to think the same thing, and say, “time for a nap” instead. But the longer I’m in business, the more I jump at the chance to learn about other people’s business systems. Maybe I need a system, but don’t know where to start. Or maybe I already have a system, but I’m not sure if it meets my needs. I think all of us can benefit by learning from other people, so maybe this will be precisely what someone else needs to read today!

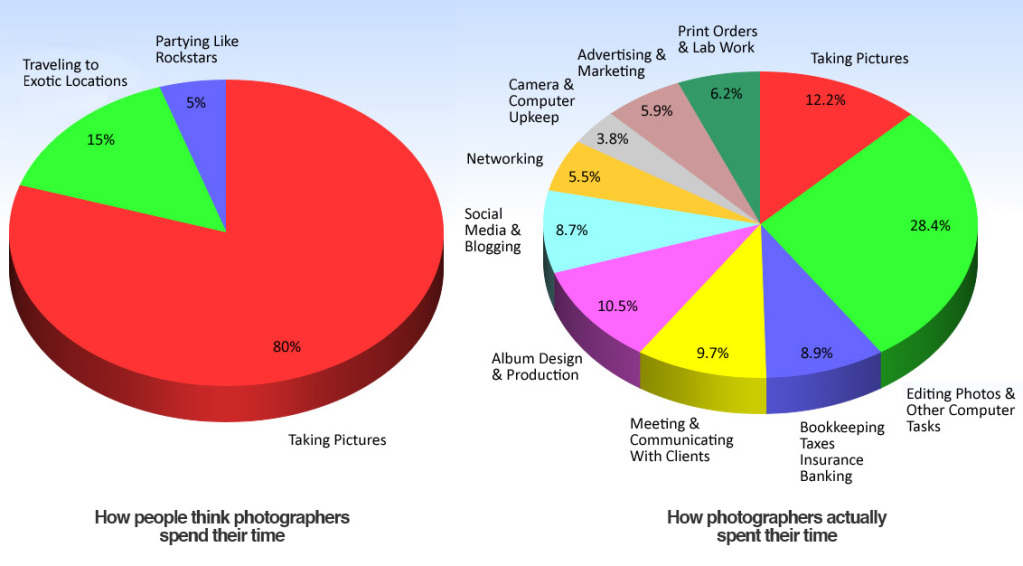

When I first started my business back in 2008, I absolutely detested the business side of self-employment. “I just want to spend my days taking pictures and caring for people,” I said. “I don’t want to spend my days on a computer or working on spreadsheets. I work for myself— is this too much to ask?” I had a skewed perspective, something like this: (SOURCE)

The reality is that most self-employed individuals spend only 10-15% of their time on their passion. The remaining work hours go into actually running the business. That may be hard to swallow, but it’s accurate. Of course, every person’s graph will look different— as we grow and develop better systems for business management, get faster at editing, and replace old forms of business growth with new ones, those percentages will change. But the fact remains:

We have to love our work so much that we’ll keep working at it, even when it means doing “boring” work 90% of the time.

With that in mind, I want to talk about one of those “boring” areas— budgeting. I was so good at budgeting when I was a teenager. I used an envelope system, saved up for every purchase, and never spent more than I had in my budget at the time. Model teenager, right?! Ha! Then I went to work for a non-profit (and by “work” I mean, mostly an unpaid internship), and I was broke all of the time. So my budgeting system went out the window. I still lived within my means, but the envelope system no longer worked for me. And then I started into photography… and things got even worse. Again, I still lived within my means, but because I never had consistent income, I never knew when I could spend and when I needed to save for the upcoming month. To be entirely honest, this is just a reality for the self-employed creative— we never have consistent paychecks, so we have to figure out how to “balance” our income and plan, without really knowing where our next check (or meal, sometimes!) is coming from.

So how then do we go about planning, when we don’t have control over who books us or when the money is coming in?

At the end of the day, this lifestyle just requires a lot of faith— every dollar in our pockets comes from the generous hand of our kind God. Steady paychecks make us feel like we’ve earned it and that life is stable, but the reality is that we literally depend on God for our daily bread. Self-employment serves to keep this truth in the forefront of our minds, more-so than a traditional job would.

Still, it’s wise to have good systems in place to track everything!! There are many tools out there for income and expense tracking (some of which I should probably use), but I’m going to share my income and budgeting method. This is a very simplistic format, but it’s been helpful for me!

1. Learn Your Costs

If you’ve never downloaded Stacy Reeve’s Free Pricing Guide for Photographers, go do it now. I’m serious. If you’re self-employed but not a photographer, you should still go download it— it’s that helpful. She walks through basic steps to finding your Cost of Living, Cost of Running a Business, and Cost of Shooting a Wedding. Yes, it’s important to know these factors for figuring out pricing… but it’s also vitally important to keep these numbers in mind after the check is in hand, so we know where the money goes once it’s in the bank!

2. Track All Income

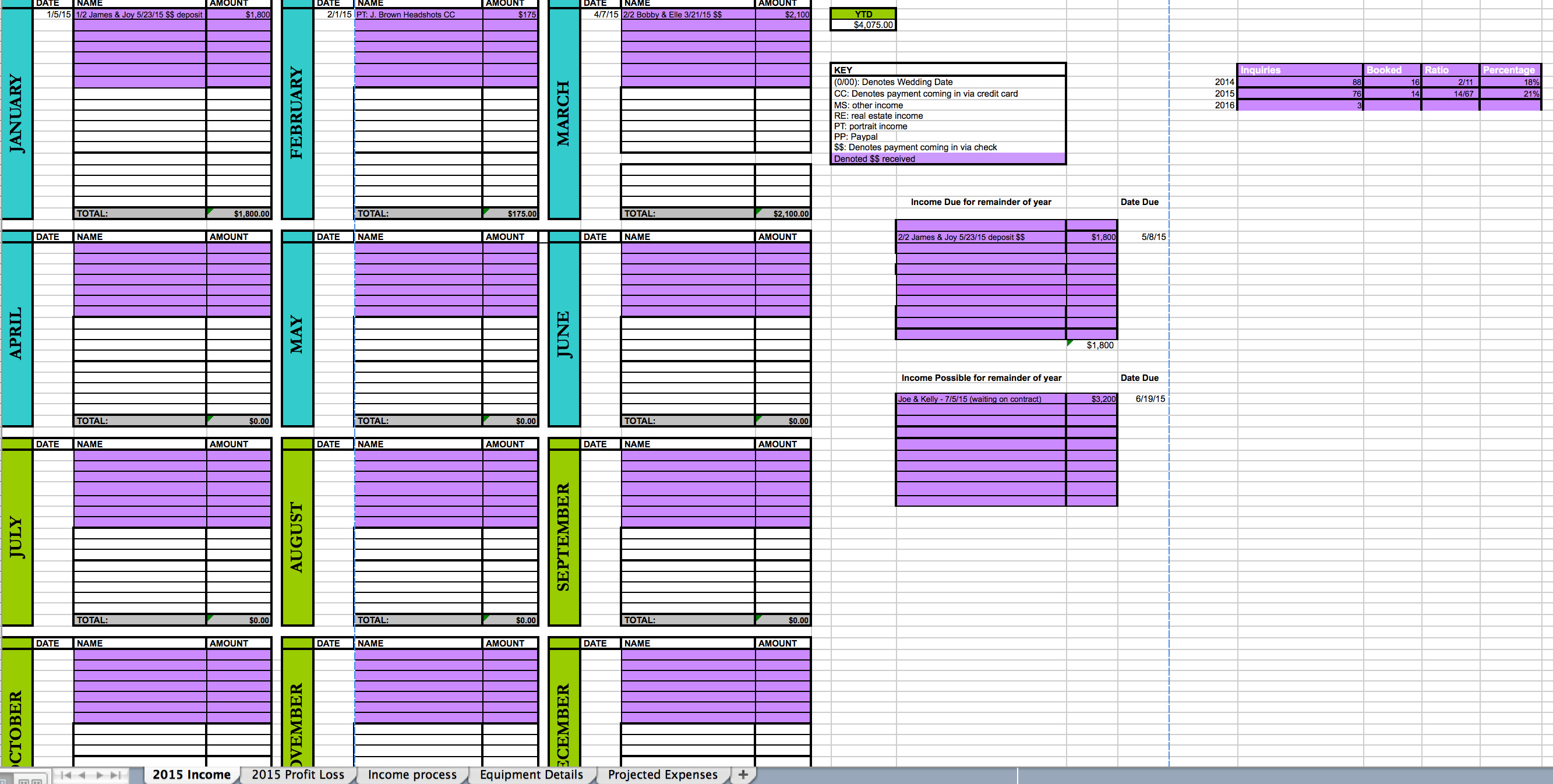

A few years ago, Zach & Jody Gray did a blog series about finances for photographers. You can see that series, and more, here. In one of their posts, they shared the Excel spreadsheet they used to keep track of their finances. I downloaded it and tweaked it (a lot) to work for me and my business, and it’s been my cornerstone ever since.

Of course there are more modern ways to track income, but I love how detailed this spreadsheet is. It’s fairly self-explanatory, but feel free to email me if you have questions! I usually list wedding income in the purple sections, and portrait or other income in the white sections, just to give me a better visual.

This main page also lets me track when checks are due, possible income for the year (pending contracts, etc), and my booking rate (booking rate is a whole other blog post, but it’s really fun to track!), all helpful data points for monitoring business!

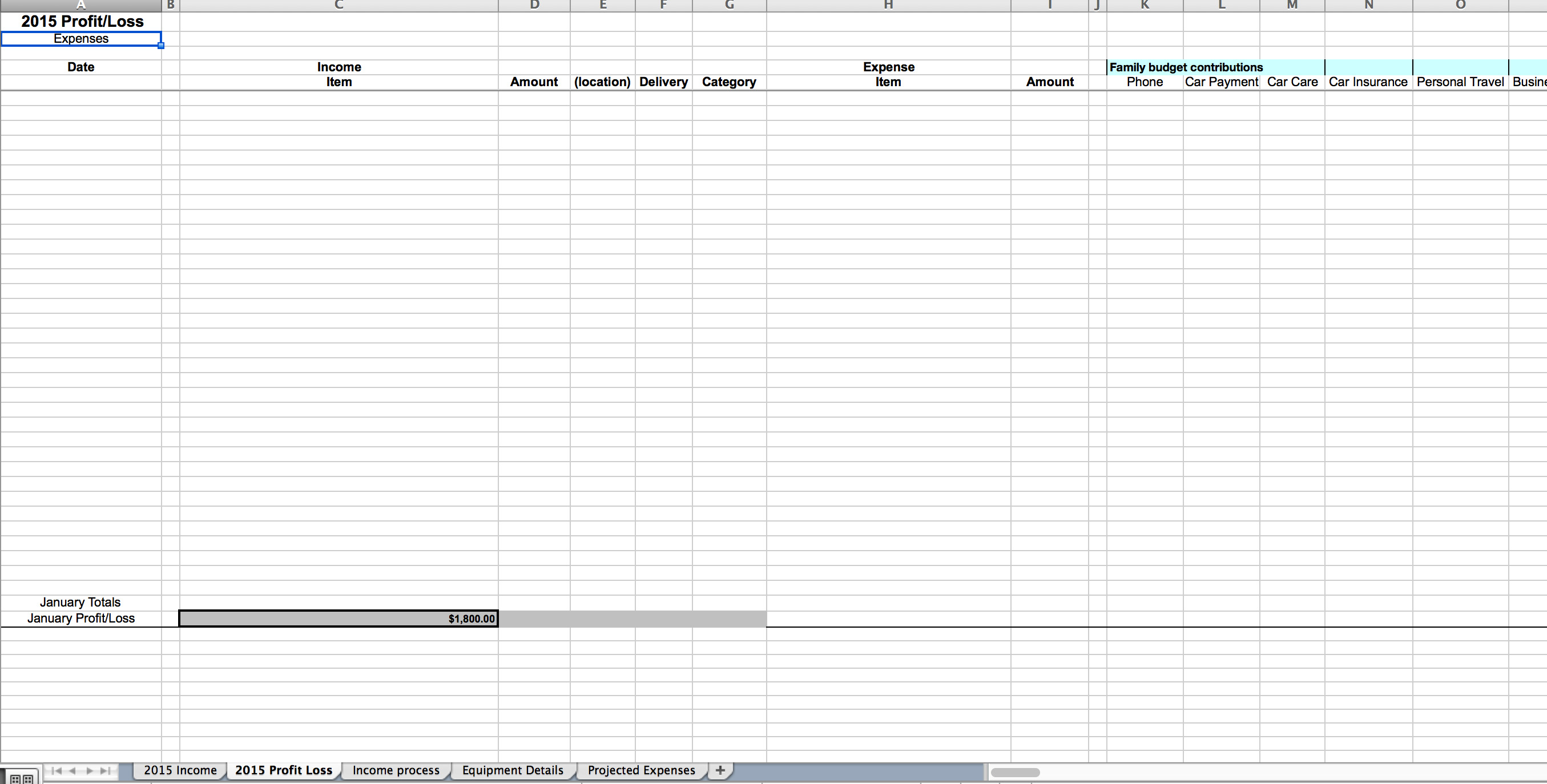

3. Track All Expenses

Again, there are automated ways to categorize expenses, and I am beginning that transition… but this is so easy!! Income categories (for my accountant) at the top, and expense summary at the bottom. Easy-peasy, right?

Of course you’re asking about the “income item” line— I put that in at the end of the year, as a way of “checking my work” as I prep for taxes. Its basically just another version of the income sheet, but it includes where products are delivered (this is for sorting out sales tax).

4. Categorize Income

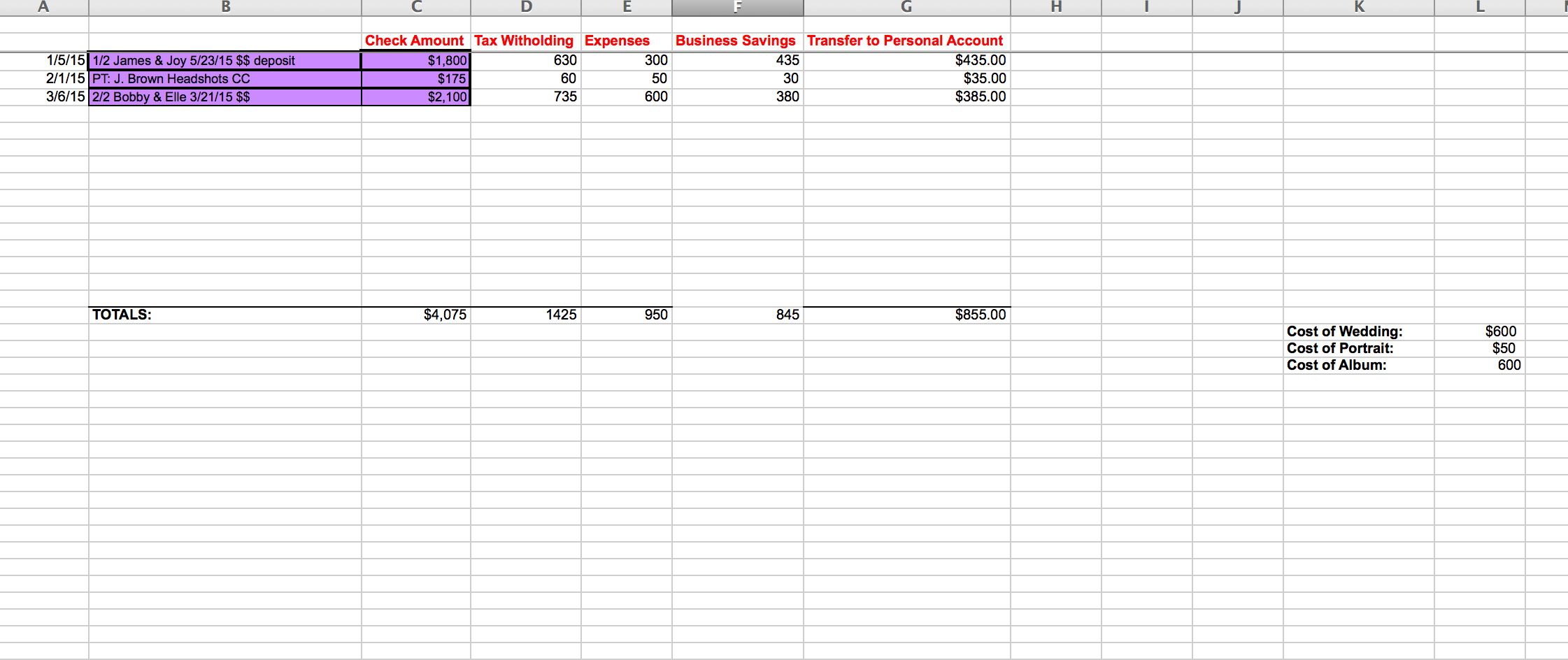

So this is the fun part, where we break down exactly what I do with income when it comes in.

- Income. Copy income details from Spreadsheet 1 to Spreadsheet 3. Basically, just copy and paste.

- Tax Withholdings. This varies by State, but it’s generally somewhere between 25-35%. Sucker punch to the gut, right? DC has high tax rates, and I have to charge a 5.25% sales tax, so I take 35% from each check (amount on check x 0.35 = tax withholding). This should go into a bank account and sit untouched until it’s time to pay taxes. I have three free checking accounts with my bank— one for personal banking, one for business banking, and one for taxes money. The tax money account is used as a holding account, but has no debit card or checks associated with— it’s literally only there to hold money, and keep it out of my other accounts (so I don’t spend it before it’s time).

- Expenses. This refers to expenses specifically related to the shoot or event I photographed. This is why you need to go through Stacy Reeve’s workbook and figure out expenses! I have an example number here— $600 for out-of-pocket expenses to shoot a wedding. Because I take wedding payments in two parts, I divide the expenses into two parts, as well. This also get’s put into the the “holding account” until it’s needed.

- Remaining income. I divide the remaining income pretty much evenly between “business savings” (which goes toward non-event-related expenditures such as Internet, equipment, and continuing education), and “transfer to personal account” (which is my “paycheck”).

As you can see, not a ton of it ends up making it into the personal category! Of course, that amount can change based on business expenses (some are adjustable) and business savings, but the tax category is pretty much set in stone.

There are two other pages in Excel file:

- Equipment Details, where I list out all of the equipment that I own, along with purchase date, price, and serial numbers (easy access for repairs, insurance, and when tax time rolls around again).

- Projected Expenses. This happens in conjunction with my yearly planning. I take a look at what I’m hoping to accomplish in the upcoming year, the major purchases I hope to make, and then factor that into my overall budget.

I take all of this information, compare it against the previous year’s expenses, and set myself a budget in Mint, just to have an overview of how I’m doing on a daily / weekly basis.

Obviously, this is just the very basic start to a larger question of budgeting with variable income, but I hope at least some find it helpful! I’d love to hear other methods that work for you!

So good to share, even when it’s the not-so-fun side of owning your business. But good to know!

Thank you for sharing this! Very helpful for me!

SO helpful, Sarah!

Thank you for this insight!! I detest the business aspect of this whole thing, too 😉

So helpful!! I’m going to be saving this and reviewing it when I go over my business money for taxes next month and hopefully change my process to be like this!